What will be the future of Savings and Credit Cooperatives (Credit Unions)

It has been almost a century and a half (148 years) since the first Savings and Credit Cooperce in the region of 13.6% of the banking market:

The banks have the difference (86.4%).

1.- Let’s read a very short history about Savings and Credit Cooperatives (Credit Unions) in Latin America

According to the World Council of Savings and Credit Cooperatives (WOCCU)

In 2024 there were 2,327 Credit Unions serving 50.4 million Clients/Associates in Latin America.

With an average share of 13.6% of the banking market.

Although in 1876 the first Credit Unions were born in Mexico and Argentina, I had the opportunity, in a series of talks I gave in Brazil, to visit the “Plaza del Emigrante” in Nuova Petropolis, where there is a reconstruction of what that town was like back in 1902; when the Jesuit priest Theodor Amstad, a German and expert on the Raiffeisen System, founded the Caixa Rural de Nuova Petropolis in Brazil.

In other Latin American countries, the French system of Alphonse Desjardins was more influential, who in 1900 imported the French financial cooperative model to Latin America, being more similar to that of the “Credit Unions” of the USA.

These movements have been very successful in Latin America, having completed almost a century and a half (148 years) since their arrival in the region.

Until 1986, the Latin American Credit Unions could be said to have functioned through the self-control of their Federations, which progressively ensured that their affiliated Credit Unions respected accounting regulations and good financial practices.

The Latin American Federations also created the first Deposit Guarantee Funds.

Credit Unions did not have access to the Banks’ Guarantee Funds.

The “historical” failure cases most remembered of Credit Unions closures were:

- San José Obrero (Bolivia),

- Caja Popular de Cooperativas (Colombia),

- Septiembre 8 and San Francisco de Asís (Ecuador)

- COFAC (Uruguay) and

- Coopemex (Costa Rica).

The fact is that

Since the 80s, laws, were progressively approved to regulate the Credit Unions through.

- Specialized Banking Regulators (Social Economy Superintendencies,

- National Institutes of Cooperatives,

- Departments of the Ministries of Finance depending on each country or,

- Assigned to the existing Banking Regulators.

As was the case of the “Rural Cajas” that are under Spain ‘s Banco de España supervision and in same way other Spanish-speaking countries of Latin America control their respective Credit Unions.

Today

In 2024, it could be said that In Latin America the vast majority of Credit Unions

Are regulated with surveillance and control systems similar to those of banks.

Therefore

They have been incorporated as licensed “Credit Entities” have being authorized to:

- Receive deposits from the public, besides those of the Associates,

- Being supervised by the governments

- And covered by the National Banking Deposit Guarantee Funds.

Today

The Credit Union’s operation is exactly the same as that of commercial or universal banks,

Offering similar services as those offered by banking institutions and receiving in the same way deposits from the public.

From the moment the Credit Unions had similar advantages and restrictions as recipients of deposits from the public.

These had to focus more on their corporate image and less on the cooperative aspects of their business

And

More on what they do as financial intermediation institutions.

Since the only difference between the two sectors (Credit unions and Banks) is only the ownership structure by which:

The Credit Unions are collectively owned by their Members, which implies a social sensibility of helping each other.

And

Banks are mercantile companies owned exclusively by a small group of shareholders, demanding returns on their investment.

Although both are private companies.

The laws and regulations have forced the Specialized Regulators of Banking Cooperatives to separate the Financial Credit Unions from the rest of the Non-Financial Cooperatives (Workers, Shops, home building, etc.)

And

To be the Financial Regulators as strict with them as these have been with the banks.

Monitoring them with exact policies applied to both sectors.

Applied these by the Banking Regulators to Banks and the Social Regulators to Financial Credit Unions.

This brings us back to the initial question of this article.

Let’s go to the next comment.

2.- Who are the real competitors of the Social Banking Institutions?

Well

That means that the Credit Unions are now part of the retail banking market!

Because

These can receive Savings and Time Certificates

From individuals and companies.

Practically in any country in Latin America.

And

Credit Unions operate in parallel.

With the other banking establishments.

Which include

Commercial and Universal Banks, Microfinance Banks, Financing Companies and the other financial Cooperatives.

Consequently

Credit Unions have practically.

The same conditions, benefits and equal opportunities.

As the rest of their competitors.

Because:

- The Credit Unions are now regulated,

- With very similar financial products to attract deposits from the public,

- The deposits are also guaranteed by the “National Deposit Guarantee Funds”,

- They can issue Debit Cards and grant credits to their Members,

- The only difference with banks is that it is required to be a Member to receive a loan, a credit card or a microloan from a Credit Union.

The Credit Unions also must promote Financial Inclusion, something that is usually required of the other Banking Institutions to reduce the number of financially excluded people.

This is a requirement that all governments impose on all authorized banking institutions, not only Credit Unions.

The problem is that in the Credit Unions.

Tend to focus more towards social objectives,

Dedicating a greater effort to attract the economically weak segments

Of the financially excluded.

That is okay

But

Up to a limited point.

Because

In this segment of the market these the accounts

Have the lowest average balances

And

This is already the natural market segment usually attended by Credit Unions.

An example in Latin America:

According to Mexico’s BCNBV (The Banking Regulator)

In the report “Yearly View of the Financial Inclusion” in 2022 in page 41,

The average balance in savings accounts in banks was 25.893 Mexican pesos, while the average in the Credit Unions (EACP) was of 7.409 Mexican pesos:

That shows that the average balance in banks is 3,5 times higher

in banks than in the Credit Unions.

Confirming the need for Credit Unions to compete also in the savings segments with larger balances

In addition to the segment they currently serve.

But please, don’t get me wrong!

I am not saying that Financial Inclusion should not be done.

Since all Banking Institutions promote and do it

And the Regulators, usually keep the inclusion statistics.

But the Credit Unions in addition to providing Financial Inclusion like banks.

Should also attract and serve depositors with higher balances.

Because

Without Deposits with significant higher balances.

There is not enough money in the Credit Unions

To grant more loans to their membership.

Let us advance a bit more

On the other hand, we already saw before that the average market share of the Credit Unions was around 13%

And in a study by the Center for Latin American Monetary Studies, It is estimated in 2011 that the average share of Credit Unions in the Latin American financial market is 8%.

This last figure could be more, but is acceptable as the worst case.

Therefore

Credit Unions have a potential market between 87% in the worst case.

And 92% in the best case to attract banking clients.

With higher balance deposits than those of Credit Unions.

In addition to continuing to achieve Financial Inclusion.

And

Continuing to serve the sectors with weaker economies.

Those figures come from subtracting the participation of the Credit Unions from the banks’ participation, the difference becomes the part that could be covered by the Credit Unions.

3.- Potential market for which the Credit Unions should compete

Until now

The Credit Unions In Latin America have limited themselves to compete based on:

- Higher interest rates for savings and in some cases, almost doubling the difference from those of the banks

- Concentrating their largest portfolio in Fixed Term Certificates (FTC), being these the most volatile products on the market.

- Because investors continually demand higher interest rates at maturity, which makes renewal difficult and places the income of the Credit Unions at risk in the short term, if these are not renewed.

- This weakens the income flow of the Credit Unions.

Even though the savings portfolios seem to be more volatile than Fixed Term deposits.

Reality shows that Savings deposits always tend to grow, even in times of crisis.

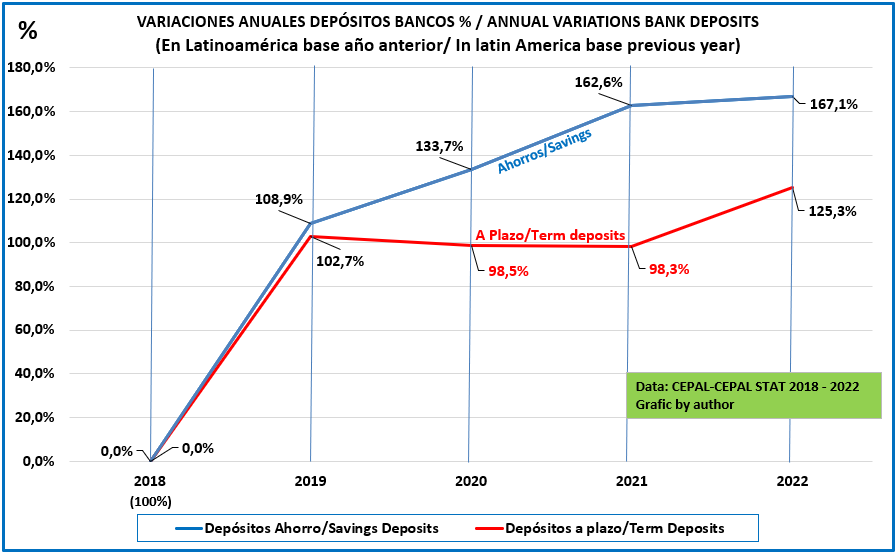

(See the following graph based on the data from CEPALESTAT that shows the behavior of the Savings and Fix Term deposits from 2018 till 2022).

The stability of the savings portfolios grew 67,1% in the 5 years centered in the 2000 pandemic

Between 2018 and 2022.

While the Term Deposits only grew 25,1%.

In fact

This shows that the pandemic hit much harder the Term Deposits growth than the savings growth.

And

The financial cost of Savings is much lower than that of Fixed Term deposits.

The fact and the experience shows that not all savers withdraw their money at once.

Unless, of course, there is a run for fear of losing the money.

But

in the case of Fixed Term

100% of the money is completely released at maturity.

The reason for banks to pay much less interest on Savings,

Is because it allows them more room for negotiation on Fixed Term deposits interest.

That’s why

The Credit Unions must do a very energetic savings marketing if they want to:

- Attract Savings

- Which in turn would help them to stabilize the maturities of the Fixed Term that are not renewed.

- Because the only way to attract savings is to do intense and sustained marketing.

Then I ask myself?

Why don’t the Credit Unions emphasize their marketing strategies targeting banks?

Using in addition to:

- The higher interest rates the other benefits demanded by the market,

- Being monitored and controlled by the government, as banks,

- On the double protection of deposits by:

- The guarantee of the National Deposit Fund (Same as in banks) and

- The Guarantee Funds of many of their Federations, be the case,

- The frequent promotions, that are a real addition to the financial products,

- The greater speed of services when they visit the branches and

- The quality of personalized attention that they provide to their depositors based on cooperative culture to Clients/Associates, this last being the owners.

All of these aspects cannot be provided in the same manner by banks

But are a part of the culture of Credit Unions,

Due to the cooperative membership of the owners and their social objectives.

Because there is no doubt that Credit Unions’ best market strategy.

Is also to attract the banks’ savings depositors.

Because the Credit Unions are already attending the market of the economically weakest.

Reaching banks’ depositors can be done promoting less the cooperative angle

And

With a more emphasis on:

- Security,

- Profitability,

- Quality and agility of the services,

To which the Clients/Associates of the Credit Unions are already accustomed to.

But

That the Banks’ clients are unaware of these differences in the Credit Unions.

You could argue me:

BUT IN THE CREDIT UNIONS WE DO NOT HAVE THE ONLINE TECHNOLOGY AT THE BANK LEVEL!

And what is the problem?

Even in the worst case that the Credit Unions do not have an online digital services as the banks:

Let me show you something:

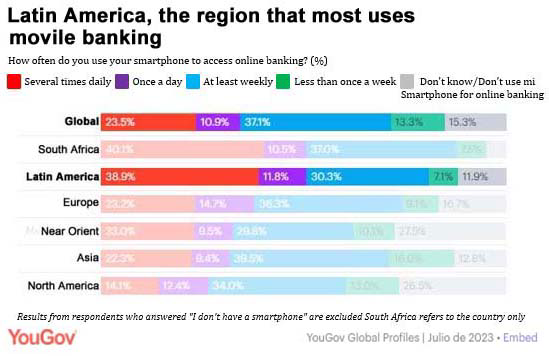

According to the YouGov study, Global Profiles from July 2023, of which I only quote the main facts:

Question: “Latin Americans are also among the consumers who spend the most time on financial sites and apps globally”.

Answer: 39.2%

Use their phone daily to pay bills and do financial operations.

The highest percentage among the regions analyzed by Global Profiles”.

You folowed this conclusion!

Now follow my reasoning!

If we take the potential market that the Credit Unions have in the bank’s clients that we show before, that is:

Between 87% and 92%,

For the Credit Unions be leveled with the banks

Attracting the biggest number of all banking savings clients.

Even if the Credit Unions cannot, attract the 39.2% of customers who use online services.

In the banks.

There would still be between: 87% – 39% = 48%

and 92% – 39% = 58%

A potential market to motivate banks’ clients to bring their deposits to the Credit Unions .

Therefore

The Credit Unions would still have a:

Huge net potential market between

47.8% and 52.8% of the banks’ share.

To attract savings accounts from

Banking clients who do not use online services!

And these banks’ savers are those who have higher balances in their savings accounts.

And are also the ones who:

- Still go to their bank offices, as well as clients and members go to the Credit Unions,

- Pay with their Debit Card, as well as clients and members of the Credit Unions do,

- Go to the ATM to take out money from their savings accounts, as well as clients and members of the Credit Unions do and,

- Make deposits in the ATM, as well as clients and members of the Credit Unions do.

In Fact

The majority of the banks’ clients behave just like the majority of the Credit Unions Members or Clients.

And

Are doing it at this moment.

But

They don’t know that:

- The Credit Unions offer the same products and services as the banks,

- In the Credit Unions they have the same or the double deposits’ guarantees than in the banks:

- These have the National Deposit Protection Fund, as well as banks and,

- The Credit Unions Federation’s own Deposits Protection Fund, that banks don’t have.

- Better interest rates,

- Much better quality of service,

- Much faster attention because the Credit Unions serve transactions in a third of the time of a bank, while these banks clients are wasting all this time when they go to their bank.

Meanwhile

The main pressure that the Credit Unions have are the Members requesting loans.

And

That there is usually not enough money to give loans to all of them.

Don’t you think it’s time for Credit Unions to start attracting bank customers?

What are you waiting to correctly motivate banking clients to come to the Credit Union?

Because

Without more deposits, with higher average balances,

More credits cannot be given,

Which is what motivates those who come to ask about the services of the Credit Unions

And

These loans could generate more income for the Credit Unions to strengthen them.

The Credit Unions in Latin America will be celebrating their 150º anniversary in 2026.

Happy birthday to you in 2026!

And, make your Credit Union more solid and happier!

And

Hurry up!

English Blog jlinaresf © 2024 by Jose Teodoro Linares Fontela is licensed under Creative Commons. Attribution-NonCommercial-ShareAlike 4.0 InternationalWhat will be the future of Savings and Credit Cooperatives (Credit Unions)